El Niño’s impact on Peruvian blueberries

Peru's ascendancy in the blueberry industry can be attributed to two pivotal factors: climate conditions and the genetic suitability for blueberry cultivation. An optimal temperate climate with a desert-arid-subtropical character prevails across nearly the entire coastal expanse.

This climate fundamentally ensures high-quality blueberries. Moreover, this is of paramount significance in expediting the early-stage blueberry production and accelerating varietal replacement trials, compared to other geographic locations.

“It is possible to plant a new blueberry cultivar and initiate its exportation within a mere eight months, bestowing Peru with a competitive advantage in this swiftly evolving industry,” says Luis Miguel Vegas, general manager of Proarándanos.

This contributes to the ongoing transformation of Peru’s blueberry varietal landscape.

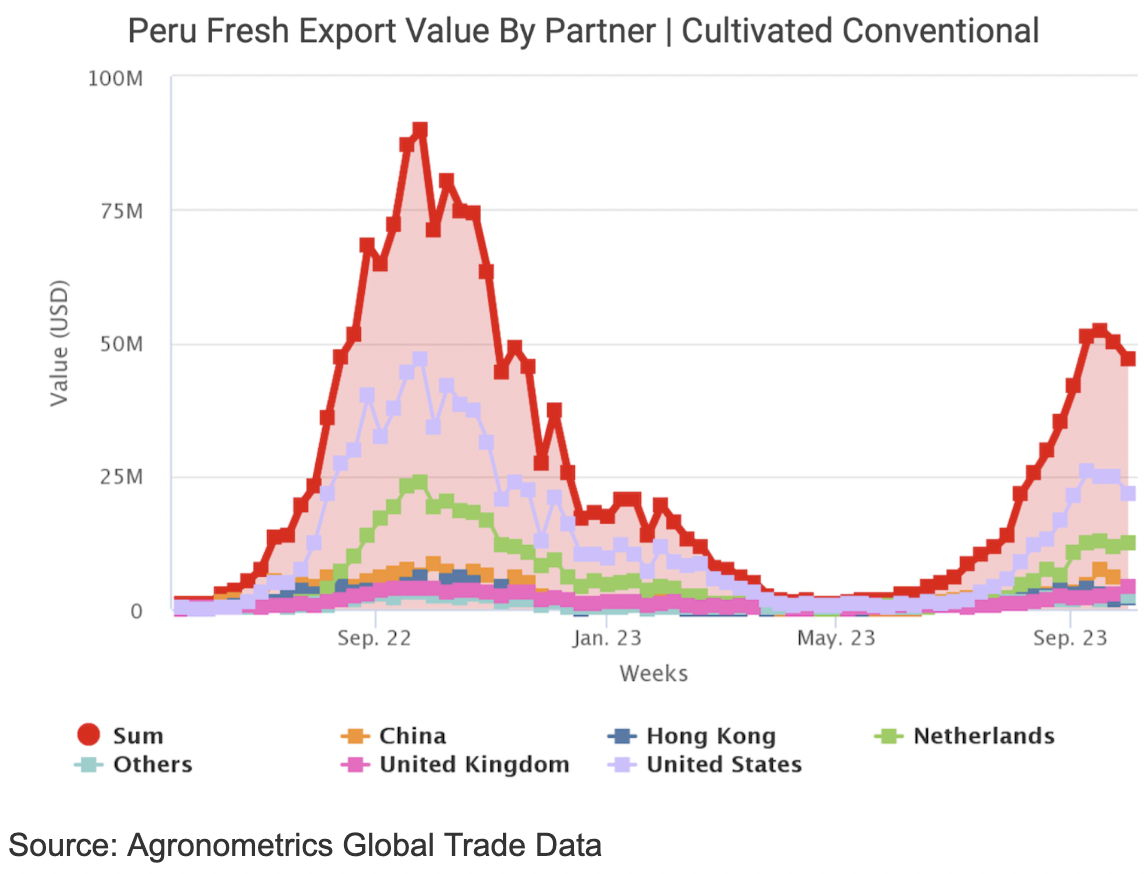

In the 2022-23 season, ending April 23, Peru exported a record 286,000 tons of fresh blueberries, according to industry data.

However, the 2023 blueberry season has brought unique challenges, primarily due to the impact of El Niño. Unusually warm weather, with temperatures approximately nine degrees Fahrenheit above historical averages, hampered blueberry production.

This blueberry season in Peru saw plummeting production, with around 60,000 tons produced.

“Until the end of October, we are going to continue with volumes between 40% and 50% below last year and for the following months, there should be a recovery, but we do not know what the extent of this recovery will be. We will have to follow production closely in the following weeks,” says Vegas.

Various blueberry cultivars have exhibited distinct responses to the climatic conditions induced by El Niño. While some have consistently sustained their production levels, others, such as Ventura, have encountered setbacks resulting in delayed harvests or reduced yields due to inadequate cold hours.

This divergence in the weather's influence has presented formidable challenges for both cultivators and exporters.

“There are producers with certain varieties that have been performing very well, despite the weather, having excellent size, quality and arriving at their destination in excellent condition, but there are other varieties that are not even producing, that have not even been able to be exported,” says Luis Miguel Vegas.

As of the conclusion of week 38, the exported volume registered a notable decline of 52% in comparison to the volume recorded during the corresponding period in the preceding season. When broken down by destination, the decrease in export volumes is apparent across the board.

For instance, in the United States, which makes up 45% of the season's exports, there has been a steep decline of almost 60% in the volume sent to this destination. In Europe, comprising 22% of this season's exports, there has been a decrease of 54%. China, representing 21% of this season's exports, has seen a notable decrease of 38%. The United Kingdom, accounting for 7% of this season's shipments, is down by 31%. And for other destinations, making up 5% of this season's exports, there has been an 8% decrease.

The delayed pruning of blueberry plants to maximize production during the current season is a noteworthy strategy employed by some growers. However, it is too early to assess how this strategy will impact production in the following season. The future production levels will largely depend on the upcoming weather conditions and the recovery in the months ahead.

The scarcity of blueberries during the current season has precipitated an increase in prices, conferring advantages upon companies specializing in less-affected varieties.

Pricing dynamics have closely paralleled those observed in 2017, with average prices nearly doubling in comparison to the preceding year.

At present, Biloxi and Ventura varieties constitute a significant majority, accounting for 65% of the total production. “The dominance of these varieties is expected to recede in the coming years. It is conceivable that within the next five years, their share could diminish to approximately 30%, making way for new, more resilient, and flavorful varieties developed through genetic programs,” says Miguel Vegas.

This evolution promises to delight consumers and bolster Peru's reputation as a top blueberry producer. These new varieties prioritize post-harvest life, productivity, and, above all, flavor—factors that resonate with discerning consumers worldwide.

In response to evolving consumer preferences and market demands, the Peruvian blueberry industry continues to adapt. The industry also recognizes the potential for growth in Asian markets, particularly China. Peru aims to increase its presence in the Asian market, raising its current 15% share to 30%.

As the sector undergoes a shift towards novel and superior blueberry cultivars while delving into expansion opportunities within Asian markets, its steadfast dedication to providing high-caliber blueberries to a global consumer base remains unwavered.

This article was written by Agronometrics for IBO